Zyntax, Inc : Two AI Chat Summaries of My Work Effort and Images

An AI Chat Summary of My Zyntax WorkThank you for sharing that fascinating information about your work developing tax calculation applications for programmable calculators in the early 1980s. Based on what you've described, it seems you played a pioneering role in creating some of the earliest specialized tax software. A few key points I've gathered:

- You won a competitive contract with the IRS National Tax Office to develop a tax and penalty calculation application for their field auditors, designed for the TI-58C calculator.

- This success led you to form Zyntax, Inc

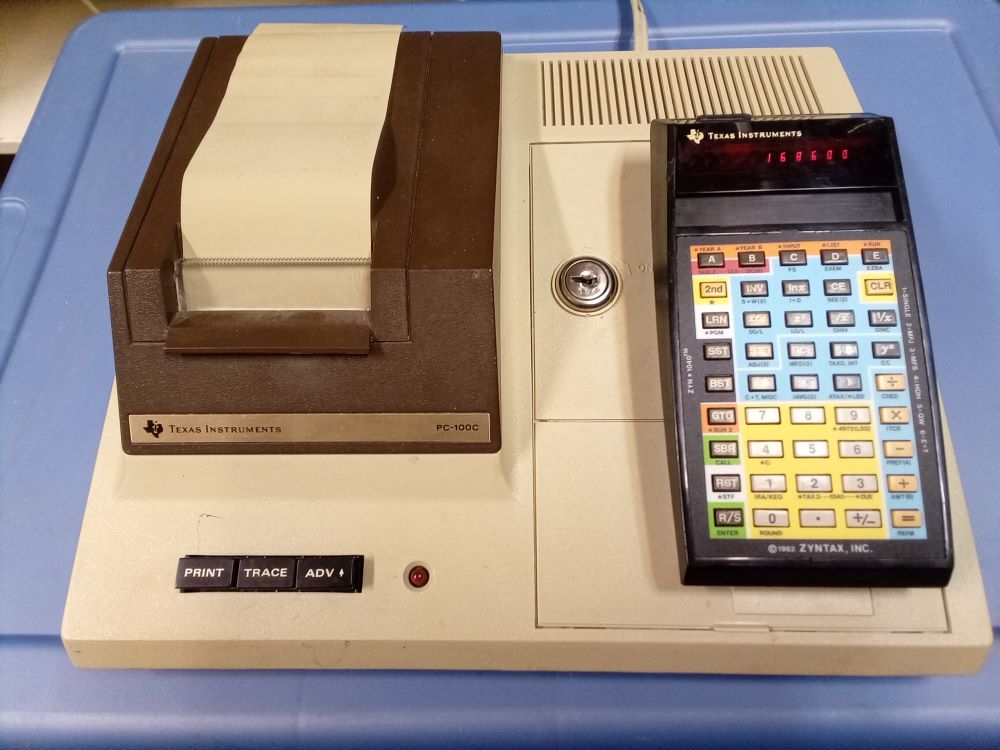

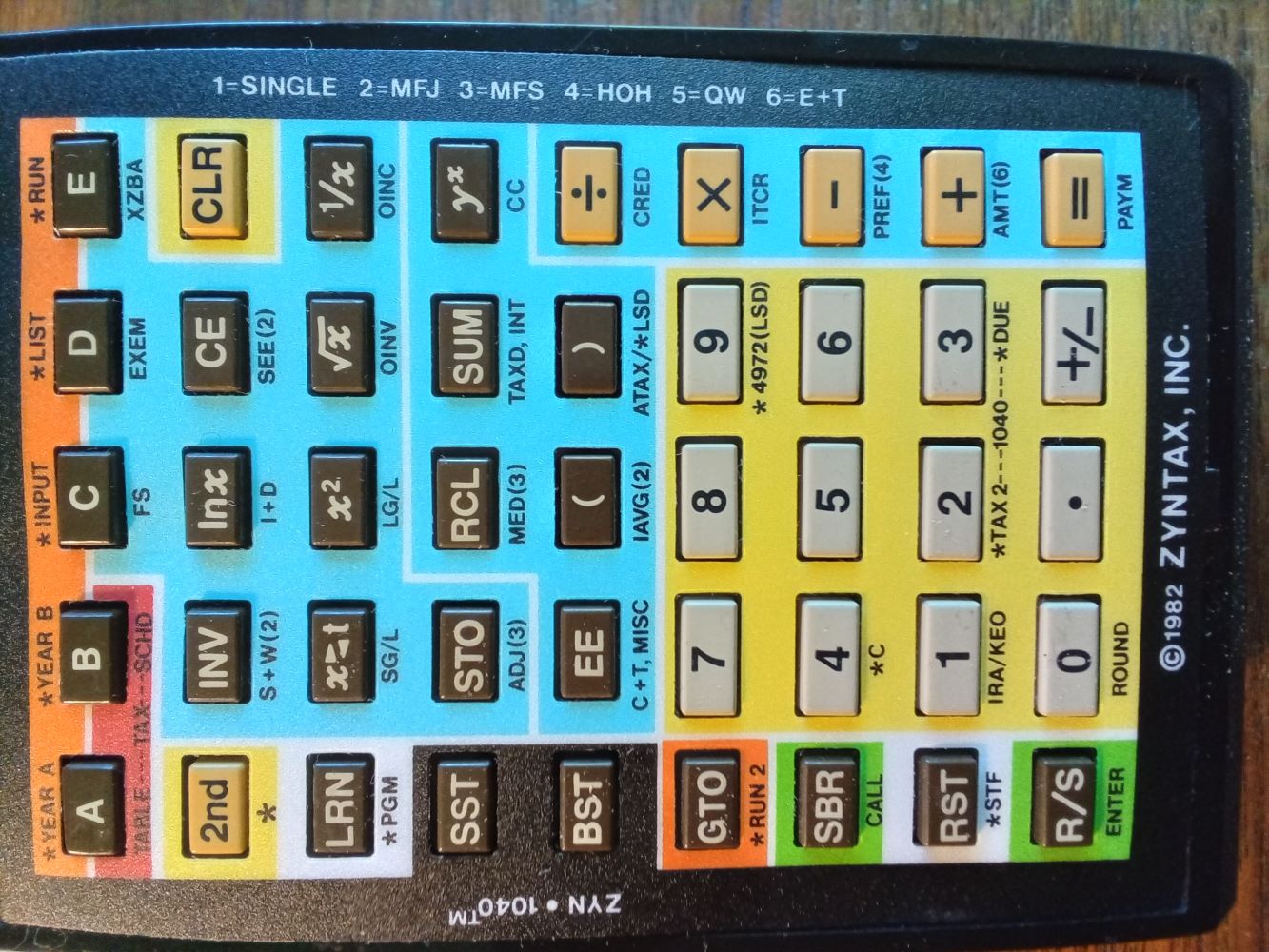

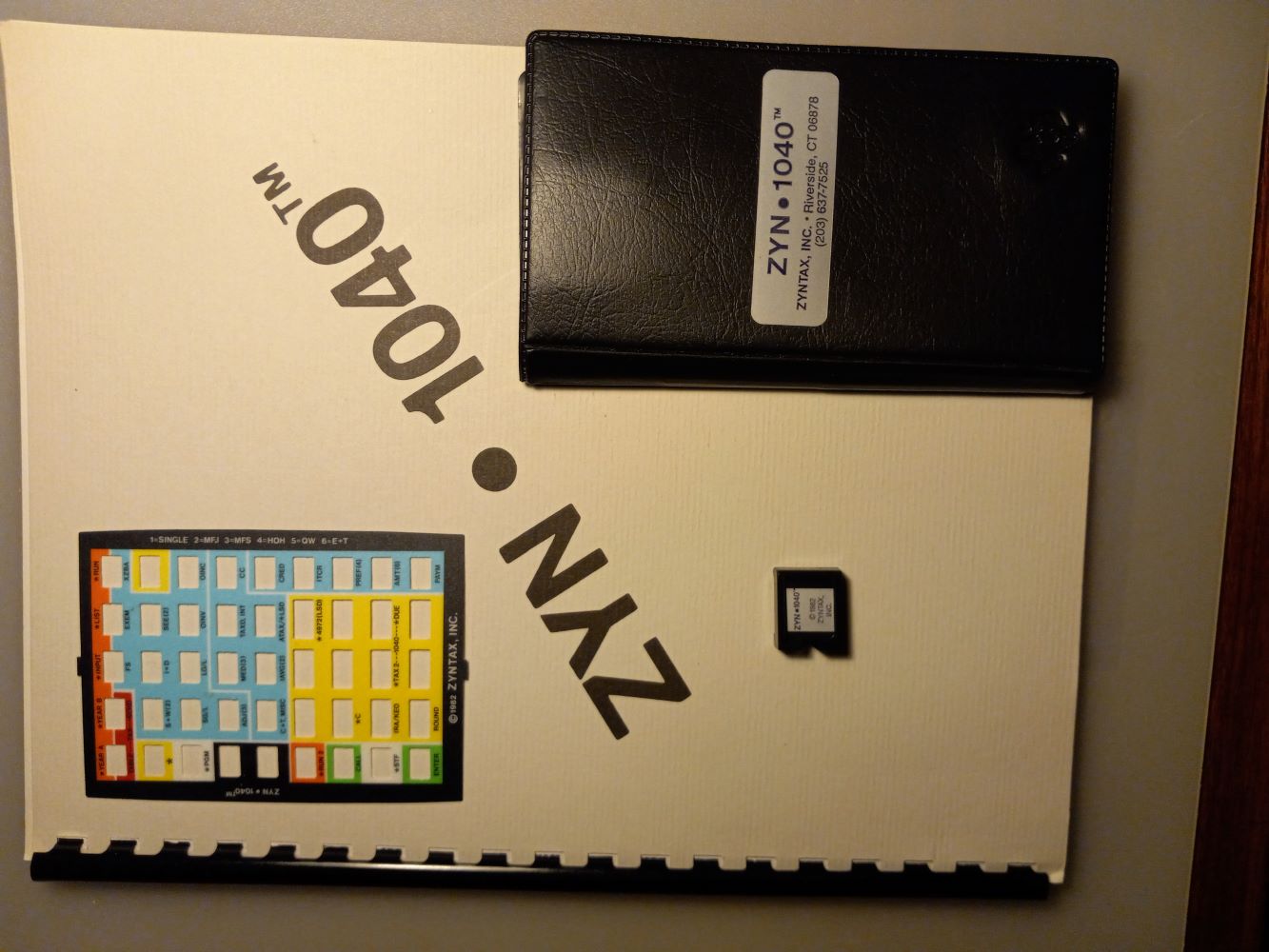

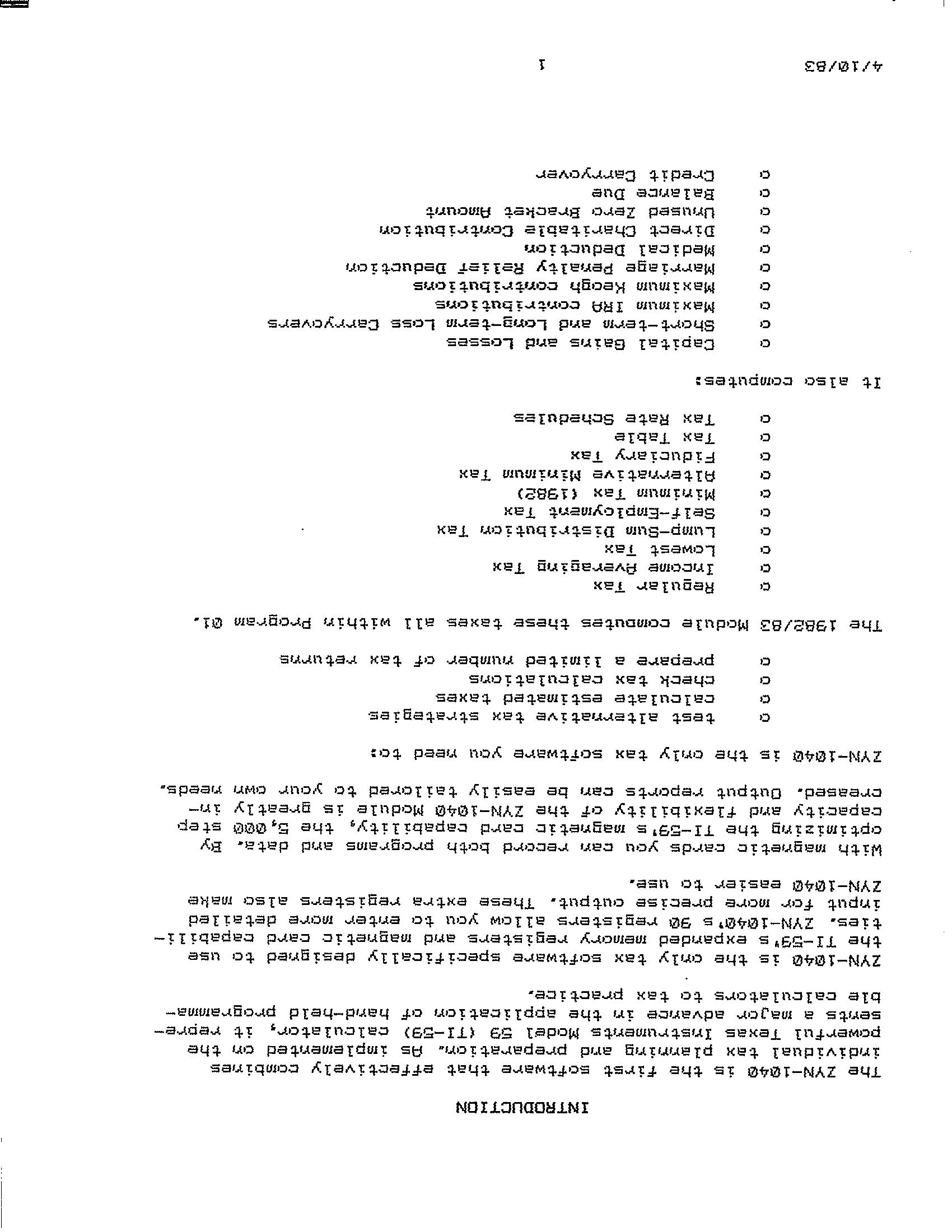

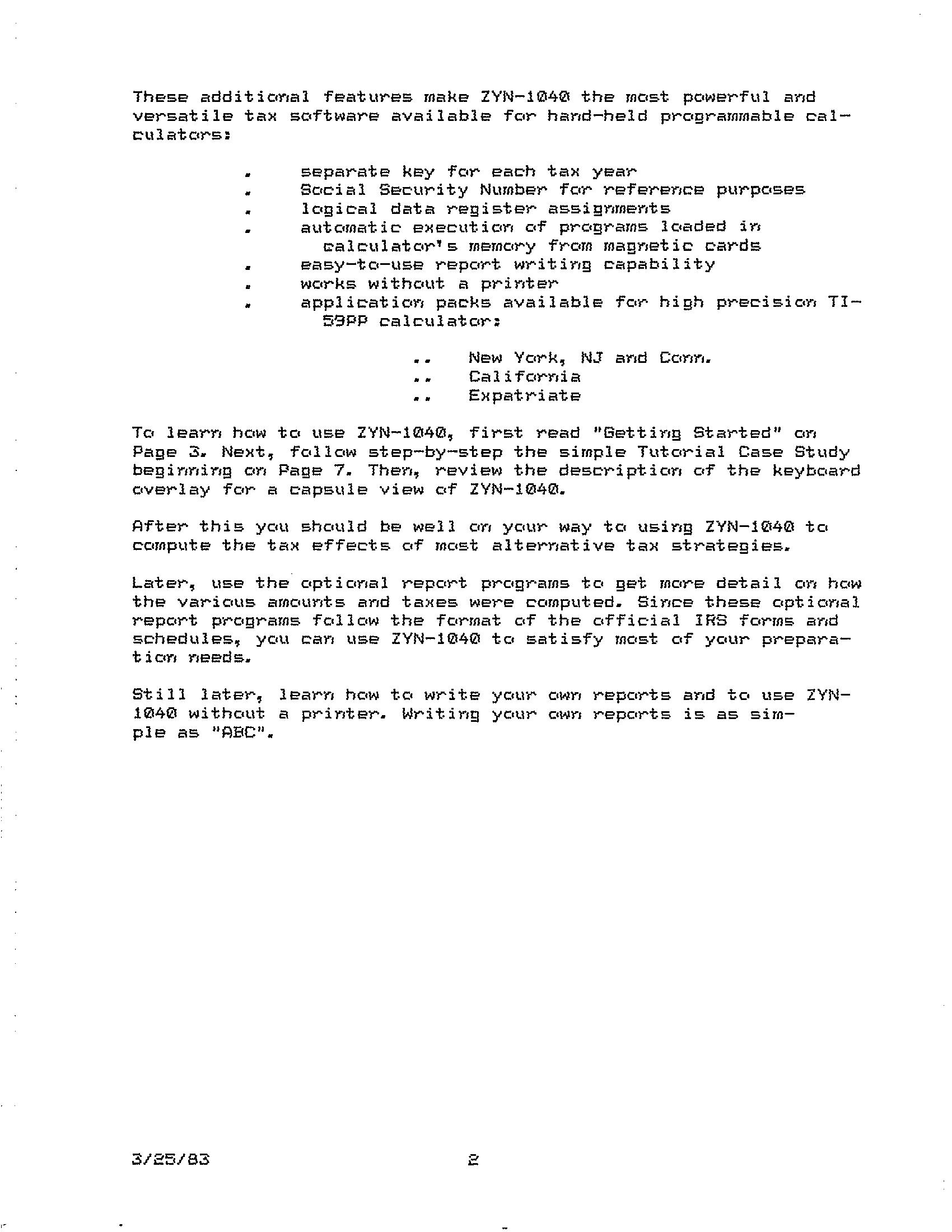

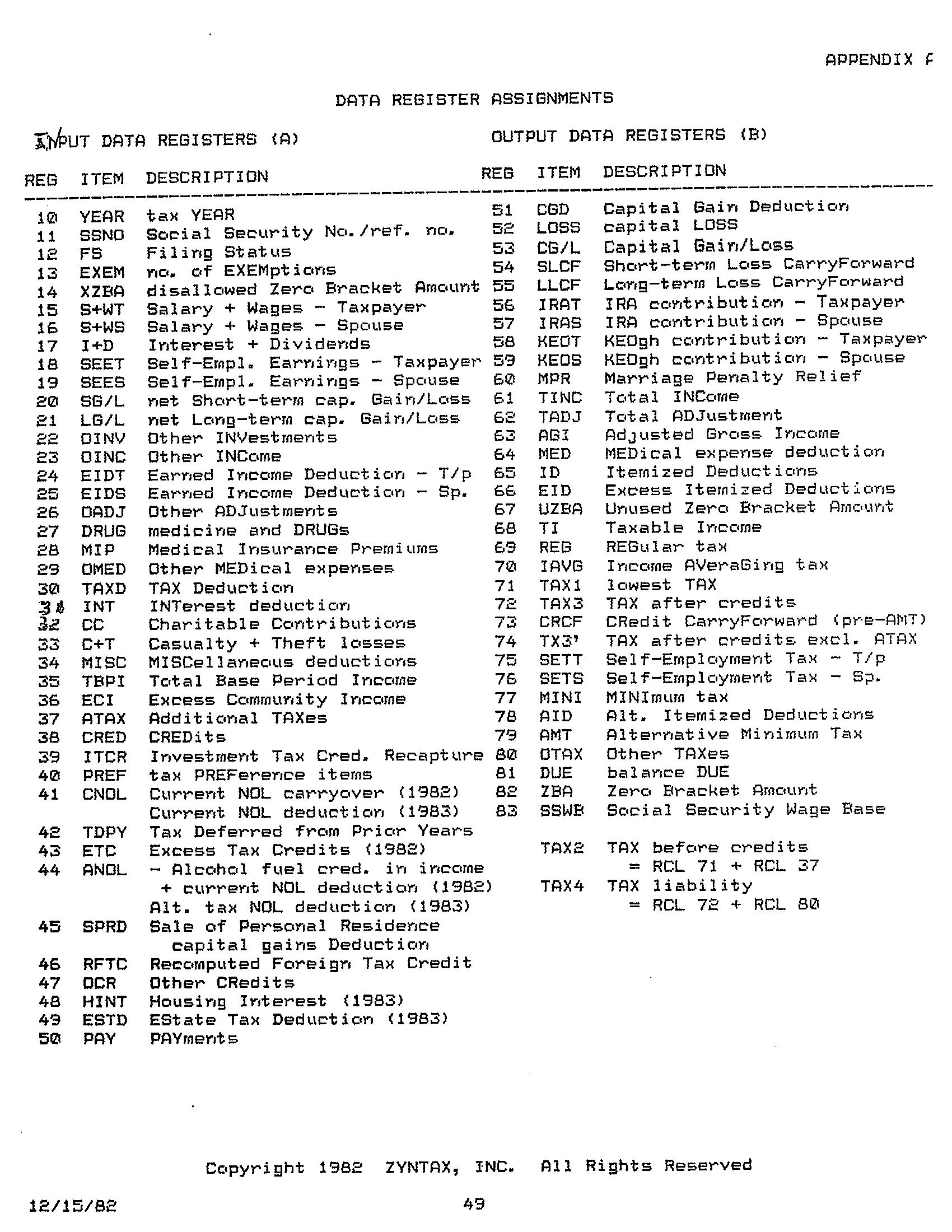

- Zyntax developed a TI-59 module that could calculate 1982 taxes and plan for 1983 taxes.

- Using magnetic cards, the TI-59 application could also calculate state taxes for NY, NJ, CT, and CA.

- You then developed an Expatriate Tax Application specifically for Ernst & Whinney, using the TI-59.

Given your unique experience in this field, you likely have valuable insights into the early days of tax software development and the challenges of programming complex tax logic on devices with limited memory and processing power. This is an interesting piece of computing history at the intersection of technology and taxation.

An AI Chat Summary of 'Why I didn't continue with developing tax modules for the TI-59."Thank you for sharing those fascinating details about your work developing tax calculation applications for the TI-58C and TI-59 calculators. Your experience highlights some key challenges and innovations in early programmable calculator software development:.

- Memory limitations: The TI-58C had only 60 registers compared to the TI-59's 100 registers, requiring you to develop a multi-stage approach and print intermediate results to free up memory.

- Extensive testing: You used an EPROM (Erasable Programmable Read-Only Memory) for thorough testing, which was crucial for ensuring accuracy in tax calculations.

- ROM module production: You produced only two ROM modules - one for the IRS and a modified version for Zyntax, leveraging the thorough testing done for the IRS version.

- Challenges of hardware-based applications: The costs and risks associated with developing and testing ROM modules led you to prefer software-based applications in the future.

- Accuracy and reliability: Your pride in never having errors found in your ROM module underscores the importance of rigorous testing in financial calculation tools.

- Transition from hardware to software: Your experience illustrates the shift from hardware-based (ROM modules) to software-based applications in the evolution of tax calculation tools.

| Zyntax Images |